Pasar saham Asia sebagian besar libur untuk Jumat Agung pada perdagangan Jumat (29/03/2024). Dolar AS juga menguat terhadap euro sebelum data inflasi utama AS

Diperbarui • 2022-12-15

The lower Bitcoin goes, the more we hear about its end. Rumors about the death of the crypto market have been here for ten years and won’t end in the future. To stay judgment-free, we need to focus on the current state of the market and the economy, not on fear, uncertainty, and doubts (FUD).

Since March 2022, Bitcoin has lost 61% of its capitalization. Increased volumes and sharp moves followed the plunge. Thus, we consider this a true movement because Bitcoin collected enormous amounts of money on its way down. Around $7.3 billion worth of crypto has been sold in the loss.

The same can be said about altcoins (all crypto except Bitcoin). The second-biggest crypto, Ethereum, lost 73% since the end of March. Despite the dump, here’s the good news. Transaction fees in the ETH network fell to the lowest in two years, only 0.3$ for a single transaction, and paved the way for retail traders who want to enter the DeFi world without thousands of dollars in their pockets.

People love explaining the reasons for the movement after it happened, and analysts are seeking “Black Swans” to crash the market. Lots of them expect Swans to spawn at least once a year. To stay ahead of the trends and be filled with useful information, visit the FBS analytics site, where news and reports are fast and unbiased.

In 2014 Bitcoin reached $170, a 86% decline from the last high, due to “more companies entering the market and increasing the circulating supply. In 2019 BTC touched the $3000 level, an 84% decline from the peak of 2017. The reason was the “Bubbly nature of crypto” (all the analysts were talking about it).

This time, the central theme of the crash is stablecoins. After Terra (LUNA) crashed, another algorithmic stablecoin was in a danger zone. USDD, issued by Tron (TRX), lost its peg to the dollar. In case of further distancing of the USDD and the USD, Tron would need to sell their Bitcoin reserves. Thus, the price may experience more pressing.

Still, please notice that overall market conditions are not the main reason for crypto to fall. Bitcoin cycles are repeating themselves and haven’t been broken even once.

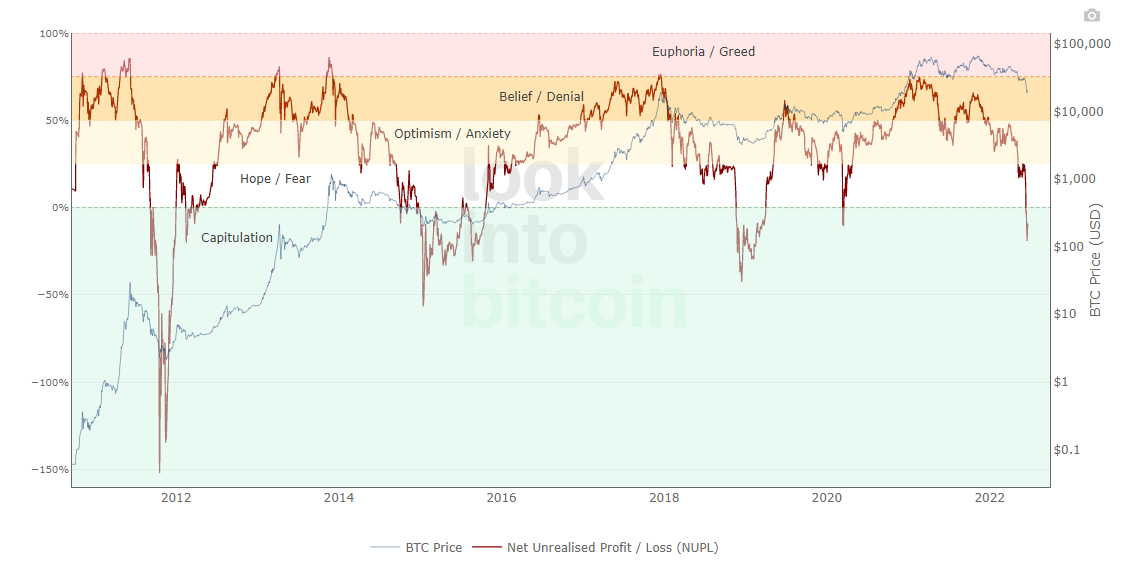

Understanding how crypto moves to forecast the future price direction is crucial. So-called “macrocycles” include Bitcoin halving, traders’ capitulation, and smart money. Considering there are 670 days till the next halving (and the next prolonged bullish rally), we will focus on traders’ capitulation.

The graphic above is the NUPL, a metric that measures the network’s overall unrealized profit and loss. It indicates that “more than 19%% of the market cap is held in loss,” which “resembles a market structure equivalent to capitulation phases in previous bear markets.” Still, there is a chance to go lower due to unfavorable economic conditions.

To sum up, we expect a local bottom of the market by the end of the summer or in September 2022. Talking about the price is more complex, but we have a point. Most of the market expected the bottom to be around the $20K psychological area. That’s why we strongly agree on breaking this level and heading lower to the next support of $13.5K. A couple of months ahead of our projections, Bitcoin may surprise us as the capitulation phase has already begun (in the figure above).

In case of breaking the $13.5K level, the next support lies at the $9.3K line. Most of the crypto market will be destroyed entirely by that time as most altcoins will make a 99% downwards move. We think that the $9.3K area will be the ultimate bottom of the crypto market if the price reaches this zone.

The only crypto worth looking at in addition to the BTC is ETH, the most popular DeFi-oriented cryptocurrency with fundamental reasons to rise and thrive. Consider trading other coins only as speculative assets until the next halving as they will be very fragile. Or you can practice your trading with a demo account designed for you to test every strategy and enter the actual game with skills and needed abilities!

Pasar saham Asia sebagian besar libur untuk Jumat Agung pada perdagangan Jumat (29/03/2024). Dolar AS juga menguat terhadap euro sebelum data inflasi utama AS

Dolar Australia menguat tipis di awal perdagangan akhir pekan ini, namun masih dalam tren penurunan. Pasar diperkirakan sepi karena memperingati Jumat Agung. Dolar AS menguat karena data ekonomi AS menunjukkan ekspansi,

Pasar saham Asia memiliki sentimen sideways dengan bias bearish pada perdagangan Kamis (28/03/2024), karena adanya sentimen ketidakpastian menjelang data indeks harga PCE AS..penjualan ritel Australia dirilis lebih kecil dari perkiraannya.

Yen Jepang gagal memikat para investor pada perdagangan Selasa (02/04/2024) meski ada peluang atas kemungkinan intervensi dan..Sentimen penghindaran risiko masih berpotensi memberikan kekuatan pada safe-haven

XAUUSD naik ke rekor tertinggi baru pada perdagangan Senin (01/04/2024), di tengah meningkatnya spekulasi penurunan suku bunga..melanjutkan kenaikan kuat minggu lalu hingga membentuk level puncak baru sepanjang masa

Pasar saham Asia sebagian masih libur dan sebagian lagi menguat pada perdagangan Senin (01/04/2024), karena optimisme data pabrikan Tiongkok mendukung..potensi intervensi otoritas Jepang terhadap yen Jepang diperkirakan berada di zona 152 – 155 yen.

FBS menyimpan catatan data Anda untuk menjalankan website ini. Dengan menekan tombol "Setuju", Anda menyetujui kebijakan Privasi kami.

Permintaan Anda diterima.

Manajer kami akan menghubungi Anda

Permintaan panggilan balik berikutnya untuk nomor telepon ini

akan tersedia setelah

Jika Anda memiliki masalah mendesak, silakan hubungi kami melalui

Live chat

Internal error. Silahkan coba lagi

Jangan buang waktu Anda – tetap awasi dampak NFP terhadap dolar dan raup profitnya!